By Ian Bickis

THE CANADIAN PRESS

A First Nation-led financing model has reached $2 billion in loans issued as it works to close the economic and infrastructure gap between member nations and the rest of Canada.

The First Nations Finance Authority is crossing the lending threshold a decade after issuing its first debenture, a type of long-term loan that isn’t backed by collateral.

The not-for-profit FNFA pools resources of member nations into a scale that allows it to offer discounted interest rates to borrowers, similar to what’s accessible to municipal or provincial governments.

Ernie Daniels, chief executive of FNFA, said during a media availability that the institution’s re-lending rate is 2.92 per cent below bank prime rates, allowing members to build much-needed infrastructure at a discount.

“With the issuance of our latest debenture, we are ensuring that 25 First Nations across Canada access $356 million now to meet community priorities including child care services, housing and job creation.”

The latest debenture, its 10th so far, will go toward projects including building housing in Cook’s Ferry First Nation in B.C., the construction of a grocery store in Glooscap, N.S. and a wastewater treatment plant upgrade in Mississaugas of Scugog Island, Ont.

The FNFA says lending since 2014 from the fully self-sufficient institution has helped create almost 20,000 jobs.

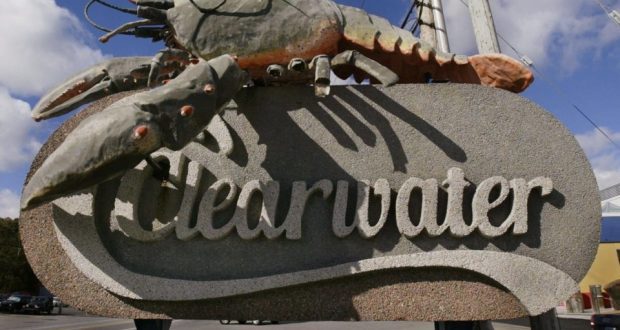

One of its biggest deals to date is helping in the Mi’kmaw First Nations’ acquisition, in partnership with Premium Brands Holdings Corp., of Clearwater Seafoods in 2020.

Membertou First Nation Chief Terry Paul, who helped lead a coalition of seven Mi’kmaw communities in buying a 50 per cent stake in Clearwater, said at the media event that the funding from FNFA was key to the deal that has been transformational.

“This is a remarkable example of economic reconciliation,” said Paul.

“We now have access to the offshore fishery from an ownership position, something we could only ever dream about before.”

The latest funding round includes $105 million in refinancing some of the outside debt from the Clearwater deal.

“Really key in this case is refinancing high interest rate debt, to the financing rates that the First Nations can get through working with the FNFA,” said Daniels.

“It’s much lower than what bank prime loan would be or even any private financing.”

The money saved by the communities through the lower interest rate has been earmarked for on-reserve low income housing and additional community programs.

The overall infrastructure funding gap among First Nations is estimated at almost $350 billion.

This report by The Canadian Press was first published Jan. 23, 2024.

Aboriginal Business Magazine Your source for Aboriginal Business News

Aboriginal Business Magazine Your source for Aboriginal Business News